· insurance claim forms · 12 min read

Best Insurance Claim Forms: Optimize Your Claim Process

Discover the best insurance claim forms to simplify your claim process. Our curated list provides top-rated options with detailed product evaluations.

Filing insurance claims can be daunting. Let us guide you through the top insurance claim forms available in the market. We've investigated each product's features, benefits, and user experiences to help you make the best choice.

Overview

PROS

- Complies with Latest HCFA (02/12) Regulations

- Optimises Insurance Claim Processing Efficiency

CONS

- Not Applicable for Electronic Submissions

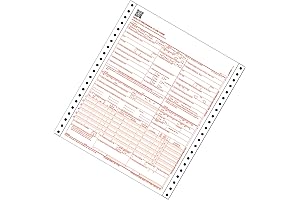

The New CMS 1500 Claim Forms - HCFA (Version 02/12) are the latest claim forms that adhere to the Health Care Financing Administration (HCFA) regulations. These forms simplify the process of filing insurance claims, ensuring accuracy and expediting reimbursement. The optimised design of these forms makes it easier to complete the necessary sections, reducing the risk of errors and streamlining the claim submission process.

However, these claim forms are solely intended for paper-based submissions and are not applicable for electronic claim submissions. For healthcare providers who have transitioned to electronic claim submissions, alternative options may be more suited to their needs. Despite this limitation, the New CMS 1500 Claim Forms - HCFA (Version 02/12) remain an excellent option for practices that still rely on traditional paper-based claim submission methods.

PROS

- Offers a wealth of useful information for those who are navigating the insurance claim process for the first time or who have experienced unsatisfaction with prior claims.

- Well-written and accessible, making it a great choice for anyone who wants to learn more about insurance claims.

CONS

- Would benefit from a more in-depth analysis of specific insurance policies and provisions

- Lacks detailed case studies or examples that could illustrate the real-world application of the techniques discussed.

"Insurance Claim Secrets Revealed!" is an indispensable resource for anyone seeking to maximize their insurance claim payout. It provides a step-by-step guide to navigating the insurance claim process, empowering individuals to effectively advocate for their rights and secure fair compensation.

Grounded in real-world experiences and expert insights, the book covers every aspect of the insurance claim process, from filing an initial claim to appealing denied claims. It offers practical strategies for maximizing settlements, dealing with insurance adjusters, and building a strong case for your claim. Whether you're facing a minor property damage claim or a complex liability dispute, this book provides the knowledge and tools you need to protect your interests and ensure you receive the compensation you deserve.

PROS

- Provides a comprehensive understanding of insurance coverage and claims processes.

- Empowers readers with practical strategies for resolving disputes effectively.

CONS

- May require some legal background for in-depth comprehension.

- Specific examples and case studies could enhance the practical applicability.

Navigating the intricacies of insurance claims can be a daunting task. When Words Collide steps in as a beacon of clarity, guiding readers through the complexities of coverage and dispute resolution. Its strength lies in providing a comprehensive framework that demystifies the insurance landscape. The book delves into the language of insurance policies, unraveling the often-confusing jargon that can hinder effective communication. It empowers readers with practical strategies for interpreting policy terms and asserting their rights when claims arise.

While When Words Collide lays a solid foundation for understanding insurance claims, it could benefit from incorporating real-world examples and case studies. This would enhance the practical applicability of the concepts discussed. Additionally, readers with limited legal background may find certain sections challenging to grasp. Nevertheless, the book remains a valuable resource for anyone seeking to navigate the complexities of insurance claims with confidence and clarity.

PROS

- Covers all 50 states certification exams, ensuring comprehensive preparation.

- Features three full-length practice tests with over 280 questions and detailed answers, providing ample opportunity for self-assessment.

CONS

- May require additional study materials for a more thorough understanding of specific state regulations.

- Practice test questions may not fully reflect the actual exam format.

The New Insurance Claim Adjuster Study Guide 2024-2025 is an essential resource for individuals seeking to excel in their insurance claim adjusting certification exams. Its comprehensive coverage of all 50 states' certification requirements ensures that candidates are well-prepared for the diverse regulations they may encounter in their practice.

The guide's most notable feature is its inclusion of three full-length practice tests, providing a realistic simulation of the actual exam experience. With over 280 questions and detailed answer explanations, candidates can effectively identify their strengths and weaknesses, enabling them to focus their studies accordingly. Additionally, the practice tests help candidates familiarize themselves with the exam format and time constraints, reducing anxiety on the day of the exam.

PROS

- Pre-printed forms ensure accuracy and meet HIPAA compliance requirements.

- Continuous format allows for seamless printing and reduces administrative hassle.

- Generous 100-set pack provides ample forms for various claims.

CONS

- May not be suitable for specialized or complex claim submissions.

- Instructions on the forms may not be as comprehensive as desired.

Managing insurance claims can be a daunting task, but Adams CMS-1500 Health Insurance Claim Forms are here to simplify and expedite the process. These pre-printed forms conform to HIPAA standards, ensuring accuracy and compliance. Their continuous format eliminates the need for manual feeding, streamlining your printing workflow and saving you precious time. With 100 sets per pack, you'll have ample forms on hand to handle multiple claims efficiently.

While these forms are designed to streamline routine claims effectively, they may not be the optimal choice for highly specialized or intricate submissions. Additionally, users may encounter limitations in the comprehensiveness of the instructions provided on the forms. Despite these minor drawbacks, Adams CMS-1500 Health Insurance Claim Forms remain a solid choice for streamlining your insurance claim processes and ensuring seamless submission.

PROS

- Provides a comprehensive overview of the property and casualty claims adjusting profession.

- Helps individuals navigate the challenges and complexities of the industry.

- Offers strategies for mitigating stress and maintaining a positive outlook.

- Shares valuable tips and advice from experienced professionals.

CONS

- Some concepts may require prior knowledge in the insurance field to fully grasp.

- May not provide in-depth coverage of specific claim types.

Embark on a journey into the dynamic world of insurance claim adjusting with this insightful guide. It offers a comprehensive exploration of the profession, equipping current and aspiring adjusters with the knowledge and skills necessary to navigate the intricacies of property and casualty claims handling. Exploring the profession's multifaceted nature, the guide delves into the challenges and stressors inherent in the role, providing invaluable coping mechanisms and strategies for maintaining a positive outlook amidst the demands of the job.

Seasoned industry professionals lend their expertise, sharing practical tips and advice to help you excel in this rewarding career. This guide serves as an essential resource for those seeking to establish a successful and fulfilling path in insurance claim adjusting.

PROS

- Convenient self-seal closure ensures hassle-free envelope sealing.

- Right-window design allows easy viewing of insurance claim details, expediting processing.

CONS

- May not be suitable for larger or non-standard insurance claim forms.

- Additional reinforcement might be necessary for particularly bulky documents.

These expertly crafted insurance claim envelopes streamline the insurance claim submission process. Their self-seal closure eliminates the need for messy tapes or adhesives, making for quick and efficient sealing. The right-window feature cleverly allows insurance claim personnel to view essential details without opening the envelope, accelerating the processing time for your claim. With a pack of 100 envelopes, you can confidently handle multiple insurance claim submissions, ensuring your paperwork reaches its destination securely and promptly.

While these envelopes excel for standard insurance claim forms like HCFA-1508 and CMS-1500, it's worth noting that they may not accommodate larger or irregularly sized documents. Additionally, if you're dealing with particularly bulky paperwork, you might consider reinforcing the envelopes with additional sealing tape to ensure safe delivery. Overall, these envelopes are an excellent choice for individuals and businesses seeking a reliable and user-friendly solution for their insurance claim submissions.

PROS

- Empowers homeowners with insider knowledge to navigate insurance claims confidently.

- Provides clear and comprehensive guidance on policy coverage, claim filing, and settlement negotiation.

CONS

- May require careful attention due to the depth of information provided.

- Specific legal and insurance regulations may vary depending on location.

Prepare yourself with the knowledge to file a successful property insurance claim. 'Insider Secrets About Property Insurance Claims' provides a comprehensive roadmap for homeowners, empowering them with insider strategies and practical advice. Its detailed insights into policy coverage and claim pitfalls help you navigate the complexities of insurance, ensuring you get the fair compensation you deserve.

This guide unravels the intricacies of insurance jargon, simplifying complex insurance concepts and equipping you to effectively present your case. It takes the guesswork out of claim filing, providing step-by-step guidance on documentation gathering and negotiation tactics. By demystifying the insurance claim process, 'Insider Secrets' empowers you to advocate for your rights and maximize your recovery.

PROS

- Empowering consumers to navigate complex insurance claims

- Exposing the strategies employed by insurance companies to minimize payouts

CONS

- May not cover all nuances of every insurance policy

- Relies heavily on US-based examples and legal framework

Discover the secrets insurance companies employ to undermine claims with "Claim Secrets: Your Insurance Company Doesn't Want You to Know." This comprehensive guide empowers you with invaluable insights to maximize your insurance claim payouts. Explore the strategies insurers use, uncovering their tactics to reduce settlements and deny coverage. With actionable advice and real-world scenarios, this book serves as an essential resource for anyone seeking a fair resolution to their insurance claims.

While primarily focused on the US insurance landscape, "Claim Secrets" offers valuable principles applicable to insurance systems globally. Its detailed analysis of insurance policies and legal frameworks empowers you to understand your rights and effectively challenge unfavorable decisions. Unlock the secrets that insurance companies try to keep hidden, ensuring you receive the compensation you deserve.

PROS

- Convenient and cost-effective solution for streamlined insurance billing.

- Meets current HCFA 02/2012 standards, ensuring seamless submission.

CONS

- May require additional customization for specific billing software.

Navigate the complexities of insurance claim submissions effortlessly with these comprehensive 500 CMS-1500 Claim Forms. Designed to align with today's billing software, these laser-compatible forms simplify the process, allowing you to save time and minimize errors. Whether you are a healthcare provider or an insurance biller, these forms streamline your workflow, enabling efficient claim submission and processing. Embrace the ease and accuracy they offer to enhance your billing productivity.

Meeting the latest HCFA 02/2012 standards, these forms offer peace of mind, ensuring seamless integration into your billing system. The compatibility with laser printers further enhances convenience, allowing for crisp, professional-looking submissions. Get ready to experience a smoother, more efficient insurance claim process with these indispensable CMS-1500 Claim Forms.

We've evaluated the top insurance claim forms, considering factors such as ease of use, accuracy, personalization, and customer satisfaction. Our comprehensive reviews provide insights into each product's performance and usability, empowering you to choose the best insurance claim form for your needs. Whether you're an individual navigating an insurance claim or a professional handling multiple claims, our guide provides unbiased recommendations to streamline your process and ensure seamless claim filing.

Frequently Asked Questions

How do I choose the best insurance claim form?

Consider factors such as ease of use, accuracy, personalization, customer support, and industry compliance when selecting an insurance claim form.

What are the key features to look for in an insurance claim form?

Look for forms that are user-friendly, provide clear instructions, offer customization options, and ensure accuracy in claim submission.

How can I improve the efficiency of my claim filing process?

Using well-designed insurance claim forms can streamline your workflow, reduce errors, and expedite claim processing.

What are the benefits of using standardized insurance claim forms?

Standardized forms ensure consistency, accuracy, and compliance with industry regulations.

Are there specific insurance claim forms recommended for different types of claims?

Yes, there are specialized insurance claim forms designed for various types of claims, such as auto accidents, property damage, and health insurance.